Last week the Central Bank published the Q4 update of their mortgage arrears dataset. In general the situation is one of steady improvement but are we missing out on some of the underlying trends?

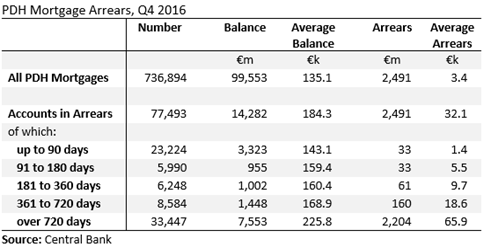

The problem is that an ever larger proportion of the arrears accounts are in the final category for those over 720 days in arrears. By the end of 2016 there were almost 33,500 PDH mortgage accounts in arrears of more than 720 days. These accounts had an outstanding balance of €7.5 billion and had accumulated €2.2 billion of arrears. Here are the reported categories as a proportion of the overall arrears problem.

At the end of 2016 accounts over 720 days in arrears were 43 per cent of accounts in arrears, 53 per cent of the total outstanding balance in arrears and 89 per cent of the built-up arrears. Can we really tell what is happening to arrears when so much is reported in an open-ended category?

We can look at what has happened to this category since it was first reported in Q3 2012.

There has been some improvement in the number of accounts in this category. The number peaked in Q2 2015 at just over 38,000 and has now fallen below 33,500. However both the average balance owing and the average amount of arrears accumulated continue to rise. There may be a compositional effect at play if it is accounts below the average that are resolved, through whatever means, and removed from the category.

Taking that aside we see that the average balance on these accounts climbs ever higher. For the full period above it rose from €203,400 to €225,800. This is likely a reflection of no or limited repayments being made to reduce the balance and the accumulated interest being added which increases in the balance.

The average amount of arrears also continues to rise and by the end of 2016 stood at €66,000 for these accounts. We know these accounts are at least two years in arrears but it is hard to know how deep they go. If the average monthly payment on these accounts was €1,500 then we are looking at accounts being, on average, something around 44 months in arrears.

It is often argued that very little has been done FOR those who are more than two years in arrears. But it is also true that little has been done TO them. It has not been possible to find comparable data for other countries in order to assess the extent to which they have experienced mortgage accounts more than two years in arrears. Other countries don’t report such figures because it is something which would not be tolerated; some resolution would be applied. That is not the case in Ireland and cases come before the courts where no payments have been received in five years or even longer.

When the “more than 720 days” category was introduced in Q3 2012 it contained 15 per cent of accounts in arrears, 17 of the outstanding balance in arrears and 48 per cent of the built-up arrears. As shown above, those figures are now 43 per cent, 53 per cent and 89 per cent. OK, part of this reflects the improvements that have seen the arrears figure fall for the past few years but it’s clear these improvements have not been reflected in the 720 day category to the same extent. A final open-ended category that contains a lot of the observations means we are limited in what can be learned from the data about some of the underlying trends.

It tells a lot about the approach to the problem that it is now necessary to introduce a category for accounts more 1,440 days in arrears.

Tweet

No comments:

Post a Comment