The previous post looked at the household sector in the Non-Financial Institutional Sector Accounts published last week by the CSO. Here we look at the non-financial corporate sector, which is where all the action is in relation to the recent leaps in Ireland’s national accounting aggregates (26 per cent GDP growth and all that), but really doesn’t tell us much about the general performance of Ireland’s business sector.

First, here’s the current account with all the figures relating to Q1 to Q3 totals for the years from 2012 to 2016.

The big jump can seen in the Gross Domestic Product (close to value added) for 2015. The 2014 figure was €82.8 billion and the 2015 figure was €123.3 billion. The step-level change was maintained in 2016.

As noted in the household accounts, there has been a rapid rise in the amount of wages paid from the corporate sector. The table above shows that ‘compensation of employees’ from non-financial corporates has increased from €30 billion in the first three quarters of 2012 to just over €38 billion for the same period in 2016.

But with value added rising by a much greater amount than employee compensation that means Gross Operating Surplus of the NFC sector is also much greater. In fact, GOS in the first three quarters of 2016 is double the level recorded in 2012: €87.4 billion versus €43.6 billion.

Perhaps unexpectedly, a substantial increase of more than €40 billion in the Gross Operating Surplus of the NFC sector has not transformed into a similar increase in dividend payments or retained earnings liabilities to shareholders. In 2012, the sum of dividends paid to and retained earnings owed to shareholders was just under €26 billion for the first three quarters of the year. For the same period of 2016 these summed to €34 billion. A rise, yes, but only equivalent to about one-fifth of the rise in Gross Operating Surplus.

This means that the resources available by use by Irish-resident entities (though not necessarily Irish-owned) has increased substantially. Compared to the first three-quarters of 2012, the Gross National Income of the NFC sector has increased 150 per cent: going from €22.9 billion for Q1-Q3 2012 to €57.3 billion in Q1-Q3 2016. Gross National Income is a key input into the determination of a country’s EU contribution.

The companies are paying additional Corporation Tax on this income with income and wealth taxes for the first three quarters of the year rising from €1.8 billion in 2012 to €3.4 billion in 2016. We should pause a little before reaching too many conclusions about the additional tax just yet as the income measures we are looking at are all gross, i.e. before the deduction of depreciation.

By subtracting income tax and netting off some capital transfers we are left with the Gross Disposable Income of the NFC sector and consistent with all the other measures this has shown a huge increase since 2012 with most (but not all) of the increase occurring with the step-level change in 2015. Retained earnings owed to re-domiciled PLCs also introduces some volatility into the series. See this note from the CSO.

Anyway, if NFCs have generated more than €50 billion of Gross Disposable Income (which is also Gross Savings as companies do not have any final consumption expenditure) in the first three quarters of 2016 it is probably worth trying to see what they are doing with it. To that end, we can start by looking at the capital account to see if they are investing it.

The first panel shows us that a huge amount of the increase in Gross Savings is being absorbed by an increase in depreciation (consumption of fixed capital). Companies in Ireland are generating substantially more gross income but a lot of this will be devoted to their capital stock which will require re-investment or replacement – or that’s what the figures indicate at any rate. As we don’t know what the assets are the link between their depreciation and the amount required to maintain and/or replace them is difficult to know.

There has been an increase of more than 50 per cent in the level of investment undertaken by the NFC sector from under €20 billion in the years up to 2014 to more than €30 billion for the two years since (again the figures are Q1 to Q3 totals). But it can be seen that even with this additional investment the amount is less than the consumption of fixed capital (i.e. depreciation) so for each of the past two years net capital formation has been negative – investment in new capital has not been sufficient to cover the depreciation of existing capital.

However, it is impossible to tell if this is telling us anything important about the Irish business sector as the figures are so heavily polluted by the impact of a relatively small number of MNCs. Investment is up because of purchasing of IP by Irish-resident entities and depreciation jumped massively because entities with huge amounts of IP on their balance sheets became Irish-resident. The underlying position of domestic Irish companies is impossible to tell from these figures.

Anyway to continue with our story. With investment less than savings this means that the NFC sector is a net lender, as it has been for four of the past five years with substantial amounts arising for each of the past two years. The figures in the table only cover nine months of each year but show that the NFC sector has had around €30 billion of net lending available. For full-year outturn the amount for the past two years is likely to come to over €40 billion.

What are the companies doing with this money? Repaying debt would seem the likely answer. The CSO only publish the institutional sector financial accounts on an annual basis so they don’t really offer the up-to-date figures that are required. We can, though, get some insight from the international investment position data published with the Balance of Payments.

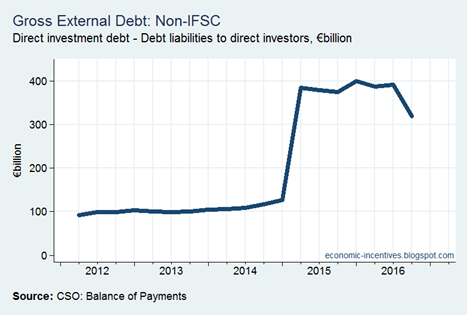

Here are the debt liabilities to direct investors of Irish-resident entities since 2012.

The huge jump (of a quarter of a trillion!) in Q1 2015 is likely related to entities with huge debts becoming Irish-resident. These entities brought assets with them and these assets resulted in the huge increase in the amount of gross operating surplus generated here. There are likely to be lots of moving parts with some companies borrowing and others repaying debt but the overall thrust of the net lending of the NFC sector going to repay the debt shown here is more than likely correct. And maybe leads to questions about the inclusion of it in our Gross National Income if these assets move on again.

And what does all of this tell us about the domestic Irish business sector? Absolutely nothing.

Tweet

Can we hazard a guess that the small number of MNCs polluting the data is actually one company - Apple!? Seems plausible form the IP data, albeit much of it now redacted.

ReplyDelete