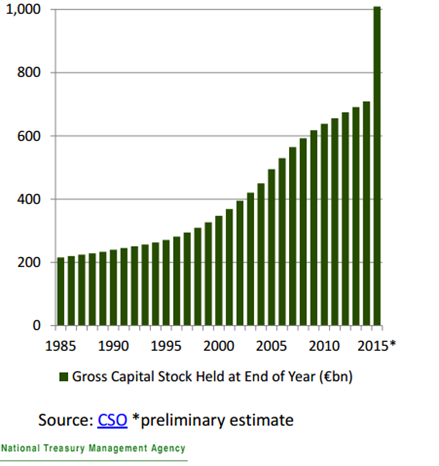

The key reason for the 26 per cent rise in Irish GDP was the large increase in the productive capacity of the economy as represented by the €300 billion increase in the gross capital stock. The addition of these assets to Ireland’s capital stock hugely increased the amount of value added that the economy could produce.

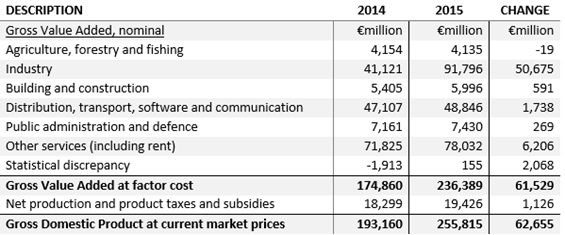

We know that most of the changes are due to the actions of MNCs so most of the increase in GVA accrued to them. Infact 80 per cent of the increased GVA came from firms in the “Industry” sector (as shown here).

If GVA formed the tax base then the provision for depreciation wouldn’t really be an issue but firms can avail of “capital allowances” for the acquisition of certain assets, i.e. they can offset (part of) the cost of the asset against their taxable income for a given period (generally eight years). This is somewhat similar to the “consumption of fixed capital” concept in national accounts where the value of capital assets is reduced as they are used and become obselete.

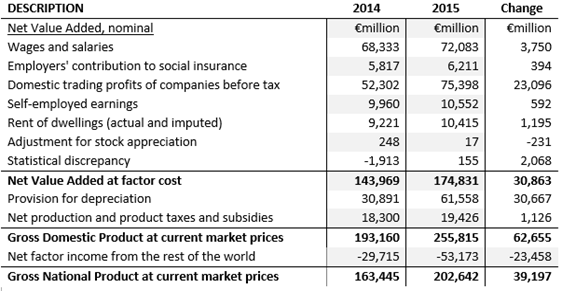

Both are generally described as “depreciation” but there are important differences between them. We only have the 2015 consumption of fixed capital figure from the national accounts for now but there is no reason to believe that capital allowances in 2015 will not have followed a similar pattern, i.e. a massive jump up.

So although there may have been a large increase in gross value added this may not correspond into an equally large increase in the tax base if capital allowances impact on the calculation of taxable income. It is a pretty safe assumption that the capital allowances used by companies increased broadly in line with the consumption of fixed capital shown in the national accounts.

So is this an issue? Possible. GDP is commonly used for international comparisons. If the amount of depreciation is the same across countries then it gives ratios that have a value in making comparisons. Here is depreciation as a per cent of GDP for the countries of the EU (excluding Luxembourg for which data does not seem to be available).

The 2015 figure is for Ireland and this puts Ireland at top of the pile and the 2014 figure shows the huge impact the 2015 figures had on our position. In relative terms Ireland now has the largest provision for depreciation though the gap to the next country, Latvia, is relatively small. As depreciation is removed from the corporate tax base through capital allowances this means GDP may overstate Ireland’s tax base relative to other EU countries.

We already knew that GDP overstated the Irish tax base as it includes the profits of MNCs based here. We can have great fun with hybrids etc. but lets just put the provision for depreciation in terms of Gross National Income (seeing as this aggregate is used in the calculation of a country’s contribution to the EU).

And here we can see the outlier that Ireland i2 for 2015 compared to the mid-table ranking for 2014. Within Ireland’s GNI there now is a disproportionate provision for depreciation. And as this is value added which is not included in Ireland’s tax base we get close to little of benefit from it.

We now have a situation where using GNP or GNI as a denominator excludes the profits of MNCs that we can get a 12.5 per cent chunk out of before they leave but includes a massive provision for depreciation for these companies that we get nothing from. If these effects offset each other then maybe GNI is a useful denominator for EU contributions and the like but with the headline data we have at the moment it is impossible to tell.

Tweet