Earlier this week Prof. John Fitzgerald had an article in The Irish Times that reached a very important conclusion. When looking at the current account of Ireland’s Balance of Payments he concluded that:

In the revised figures, rather than a significant surplus in 2014, as suggested by the unrevised data, there was actually a very small deficit

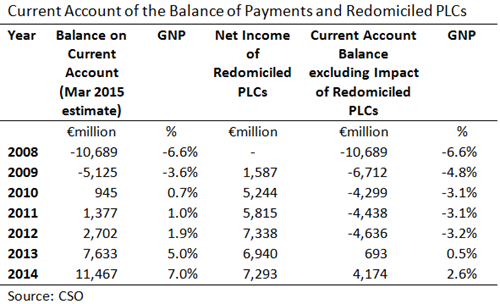

For a country with large legacy external debts and an on-going investment shortfall the current account is a very important indicator. At first glance it would appears that Ireland’s current account has improved markedly over the past few years and that are running a large surplus. Here are the first estimates up to 2014 there were published in March of this year.

The deterioration in the current account during the credit-fuelled boom can be seen but the improvement since the crash in 2008 is remarkable. Using the most recent national income estimates Ireland moves from a current account deficit of 7 per cent of GNP in 2008 to a current account surplus of 7 per cent of GNP in 2014. Fitzgerald points out two important factors that need to be considered before lauding this turnaround.

- The impact on Ireland’s Balance of Payments of companies who shift their headquarters or re-domicile to Ireland, and

- The treatment of aircraft purchases by aircraft leasing companies based in Ireland.

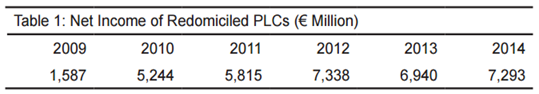

These issues were addressed in recent information notes published by the CSO. Looking first at the impact of re-domiciled PLCs. In their information note the CSO provide on estimate on the impact the retained earnings of these companies are currently having on Ireland’'

In essence this represents the retained portion (i.e. not distributed as dividends) of the profits of these companies from their activities and investments in the countries they actually operate in.. In time, these profits may be distributed to their foreign shareholders which will then make the current account worse than it actually is. For the moment, however, these profits are accruing to the Irish-based headquarters, are not being distributed and are making the current account appear better than it really is.

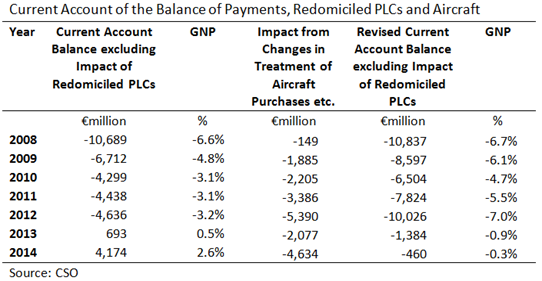

The following table removes the net income of these companies from the Current Account to try and get a better picture of the underlying balance.

There is still an improvement but the swing from the 2008 deficit of 7 per cent of GNP is now to a surplus of 3 per cent of GNP in 2014 rather than 7 per cent of GNP. This is still pretty good but Fitzgerald further points out that the treatment aircraft leasing needs to be considered.

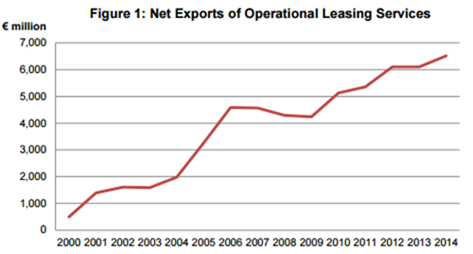

Again the CSO’s information note is illustrative. They start by pointing out the increase of net exports accruing to Ireland from operational leasing activities.

This in itself is not an issue. There are lots of foreign-owned companies operating in Ireland who contribute to our external trade surplus. And a lot of what normally happens to these earnings was previously done. If the profits were paid or accrued to a non-resident they were counted as an outflow of primary income in the current account.

However, there was one major exception: the treatment of the expenditure which led to these earnings. For aircraft leasing companies this is the purchase of aircraft. Under the old methodology most of the purchases of aircraft by leasing companies were not included in the current account of the balance of payments – they were included in the financial account of the balance of payments.

Thus in the current account we had the net inflow of income from operational leasing and the outflow of the profits due to non-residents. But of course all the operating income of these companies does not transfer into profits for shareholders as they have to buy the aircraft in the first place. The outflowing funds used to buy the aircraft did not form part of Ireland’s current account thus the previous treatment of aircraft leasing was overstating Ireland’s underlying current account.

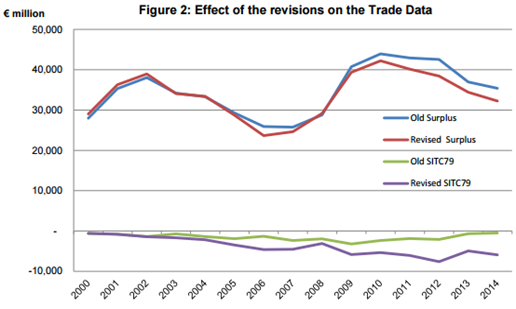

The CSO show the impact that recording this aircraft purchases (and some other minor changes) had on Ireland’s balance of trade.

It can be seen that this resulted in the recording of additional imports in SITC79: Transport Equipment other than Road Vehicles of around €5 billion for each of the past few years. These are purchases that aircraft leasing companies based in Ireland made but did not previously appear in our External Trade or Balance of Payments data because the aircraft were not registered here. The income from leasing these aircraft was recorded in the Balance of Payments though.

So if we do record the aircraft purchases in the current account where does all this leave our Balance of Payments surplus?

And like that it was gone! The revised treatment of aircraft purchases and the exclusion of the net income of redomiciled PLCs has Ireland showing a small deficit on the current account.

In December 2010, Brian Lenihan’s speech for Budget 2011 included:

The balance of payments is expected to record a small surplus next year, meaning that the economy as a whole will be paying its way in the world.

As we can see in the table above the outcome was an underlying deficit of 5.5 per cent of GNP.

Two years later and the current Minister for Finance in the speech for Budget 2013 said:

Our large exporting sector, which includes both multi nationals and growing indigenous companies is forging ahead delivering solid export growth, and a strong balance of payments surplus.

Although the improvement in the balance of payments is still pretty remarkable (from a deficit of 7 per cent of GNP in 2012 to near balance in 2014) we probably won’t be hearing much about current account surpluses this October.

In the Stability Programme Update back in April the Department of Finance said:

Over the medium term, the current account surplus is likely to fall slowly, as higher levels of investment lead to a narrowing of the domestic saving-investment gap.

There is no surplus to fund investment and Fitzgerald points out:

TweetThe revised figures have important implications for policy today. If the current account surplus had been as large as previously believed, this would have suggested significant room to stimulate domestic demand, even though this would have increased imports. However, the revised figures indicate that there is not much scope for such action. Instead, the necessary expansion in investment should be funded out of domestic savings.

No comments:

Post a Comment