This post is more questions than answers!

How much can we save if burden sharing with bank bondholders is undertaken? What is the appropriate form that this should take? Is it a problem that more than 40% of the senior debt is in Bank of Ireland?

The CB data from mid-February showed that there €63.4 billion of bonds issued by the covered six. This has now been updated to €64.3 billion as EBS seemed to forget about €941 million of unguaranteed secured senior bonds in issue. This is quite the error given that they originally said there were €1,050 million of such bonds in issue. We do not know what has happened since mid-February but here is the breakdown as it was.

Anyway, what can be done with this €64 billion? And what about the €46 billion we have already put into the banks? This is now made up of €19 billion in cash and €27 billion of outstanding promissory notes. Can we get any of this back?

With looked at in the aggregate a total of more than €64 billion of outstanding bonds in the covered six looks promising. It is likely that the upfront cost to the State of this disaster will be also be around €64 billion. This is the current €46 billion with maybe another €18 billion from the most recent stress test results. As we have stated elsewhere this can be done, but “can” and “should” are two very different verbs.

We know that some savings will be made on the subordinated debt. Micheal Noonan has indicated that he believes this will yield around €5 billion, with an assumed haircut of around 70%.

We have been told that the other €57 billion of senior debt cannot be touched. Of this, €23.6 billion is in BOI. This is the strongest of the banks and the only one that has "non-zombie" status. So far, the State has put in €3.5 billion through the purchase of preference shares by the NPRF.

The recent stress tests have shown that BOI needs €3.7 billion of additional capital to meet the stress tests with an additional €1.5 billion of a "buffer" also required. Some of this €5.2 billion will come from the €2.8 billion of subordinated bonds in BOI and it is likely that attempts will be made by the bank to raise further capital themselves in an attempt to stave off State control but a significant portion of the €5.2 billion will have to come from the State.

Is burden-sharing limited by the amount of losses in a bank itself? Can we "cross-burden share" between the banks? Can we get senior bondholders in BOI to pay for the losses in Anglo?

Similarly there is €8.9 billion of senior debt in IL&P. PTSB needs a total of €4 billion in capital (€3.3 billion for the stress tests and €0.7 billion as a "buffer"). It looks like about €2 billion will come from the sale of Irish Life and the use of other assets in the group. There is €1.2 billion of subordinated debt which will provide another chunk. Again the State will have to make up the shortfall but can we impose losses on €8.9 billion of senior debt when we will be putting in less than €2 billion in total.

The numbers are smaller for EBS which needs a total of €1.5 billion in capital and has €3.5 billion of senior debt outstanding.

Among those examined in the stress test, the one exception to all this is AIB which for some reason has been designated as a “pillar” bank. AIB has already consumed €7.2 billion of the NPRF and needs a further €13.3 billion as a result of the recent stress test. €20.5 billion is a lot of money to pay for a dysfunctional pillar bank. There is €14.7 billion in senior bonds in AIB. Unlike the other banks in the stress tests this is not sufficient to cover the level of additional capital required.

Should we just give AIB to the senior bondholders and let them fight over the carcass? It would mean abandoning the €7.2 billion we have already put in, but saving whatever portion of the next €13.3 billion is needed. With Polish and US assets sold off, and no hope of AIB raising any significant capital elsewhere, the State would have to provide the vast majority of this. It is hard to imagine any scenario where the resale of a cleaned up AIB would allow this contribution to the reclaimed.

For the two banks not included in the recent stress tests, Anglo and INBS, we have been told that burden-sharing with senior bondholders is still “on the table” but no further details are expected until information on their wind-downs is released in May. But even then the amounts left are dwarfed by the losses that these institutions left behind.

INBS has been given €5.4 billion of the State’s resources but there is only €0.8 billion of bonds remaining. Anglo, which for some reason was deemed be systematic, has had €29.4 billion poured into it . Provision has been made for a total of €34.4 billion but it is unclear if the additional €5 billion will be required. Regardless €29.4 billion is a colossal waste and the scope to get any of this back is limited to the €6.3 billion of bonds outstanding in Anglo.

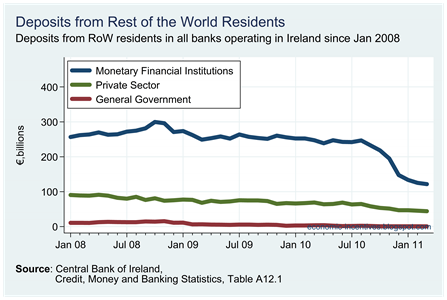

Has the strategy followed for the past two and a half years left us in a policy strait-jacket. In August 2008, the month before the blanket guarantee, there was €82 billion of bonds from the covered six held by non-Irish residents. The most recent Central Bank data put this at €28 billion – a reduction of €54 billion.

Those who could afford to pay for this fiasco are largely gone and the days of having the option to “burn the bondholders” to any significant degree could well have passed. With 41% of the outstanding senior debt in BOI, it appears that the 27% in AIB offers the only real scope for significant savings. Are we willing to give up one of the “pillar” banks?