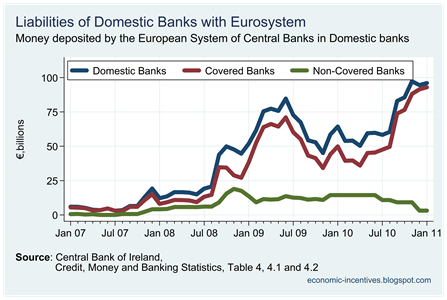

In January 2011 Irish Banks had borrowed €126 billion from the ECB. Of this €96 billion was borrowed by domestic banks with the remainder taken by the Irish operations of foreign banks.

Since October, other banks operating in Ireland have been reducing their borrowings from the ECB. Borrowings for domestic banks have been oscillating around the record levels of €95 billion recorded for the past three months.

This month we have the added breakdown of this money taken by covered and non-covered Irish banks and we can see that nearly 97% of the money was taken by covered banks.

The borrowings of the covered banks with the ECB rose to a record €93 billion in January. This is the money that replaced the outflow of deposits on the banks balance sheets. Of course, this is less than the banks needed to cover the repayment of bonds and withdrawal of depositors.

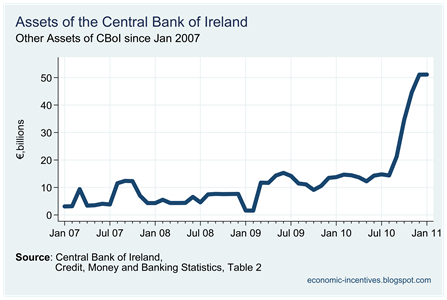

When the ECB began refusing the collateral the banks were offering, the banks turned to the Emergency Liquidity Assistance (ELA) of the Central Bank of Ireland. This is included in the “Other Assets” category in the balance sheet of the Central Bank. The money extended under the ELA makes up the majority of this total.

Although we don’t know which banks have drawn down this assistance we can pretty much take it as given that the covered banks have been the users of this facility. We know that the banks have been issuing guaranteed bonds to themselves that the ECB will accept as collateral to try and avoid using the more expensive funds from the ELA. Using the ELA is essentially further borrowing from the ECB but it is channelled through the domestic central bank (who also bear the risk of non-repayment). For more details on the ELA see this recent article.

Tweet

No comments:

Post a Comment