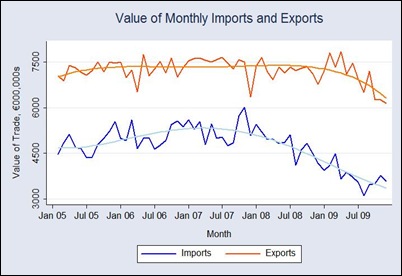

The following graph gives our trade balance from the start of 2005 through to November 2009.

The trend has turned slightly downward over the past few months, but our trade balance is still substantially higher than it was two years ago. If we break down the balance into its constituent elements of imports and exports we see that the trade balance is improving because of the rapid fall in imports. We are buying less stuff from abroad. This is shown in the following graph

After a prolonged period of stability exports have now began to trend downward. This is counter to the predictions of an “export-led recovery” that have come from many sources (see here for an example). Looking at the source of our exports also leads to some concern.

The following table shows the source of exports for the first 11 months of 2009. The table gives the value of exports from January to November in ten different categories, the proportion of total exports that these categories comprise, and the percentage change in these categories from the same period in 2008.

| Commodity | Value of Exports (€, millions) | % of Exports | Change on 2008 |

| Food and live animals | 5,695.1 | 7.35% | -12.90% |

| Beverages and tobacco | 981.4 | 1.27% | -14.64% |

| Crude materials (inedible except fuels | 833.7 | 1.08% | -32.78% |

| Mineral fuels | 552.0 | 0.71% | -30.65% |

| Animal and vegetable oils | 17.7 | 0.02% | -55.64% |

| Chemicals & related products | 44,388.8 | 57.25% | +8.40% |

| Manufactured goods | 1,144.2 | 1.48% | -26.79% |

| Machinery & transport equipment | 12,530.9 | 16.16% | -25.18% |

| Miscellaneous manufactured goods | 8,374.2 | 10.80% | +3.27% |

| Other and unclassified | 3,015.1 | 3.89% | +20.36% |

| Total | 77,533.0 | 100.00% | -2.64% |

Almost 60% of Ireland’s exports come in one sector: chemicals and related products. This category is one of only three to show an increase in exports of the 2008 figure.

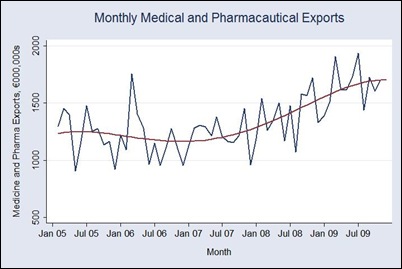

This category in itself is dominated by two commodities – organic chemicals (20% of total exports) and medical & pharmaceutical products (27% of total exports). The performance of medical & pharmaceutical exports from Ireland has been remarkable given the global collapse in trade.

Pharmaceutical exports in September 2009 were 50% higher than they were in September 2007. This strong growth has tapered somewhat recently. In fact the annual growth rate pharmaceutical exports in November 2009 was –1.2%. This is the first time this has been negative since February 2009. The strong performance in this sector masks the weak performance of exports in other sectors.

However, one would probably have to question the reality of this large increase in pharmaceutical exports. There is little evidence that pharmaceutical companies have been increasing output. There is little evidence that pharmaceutical companies have been taking on additional workers. There is little evidence that pharmaceutical companies have been expanding their manufacturing facilities. How have exports in this sector risen by over 50% in the last two years?

It could be that much of it is simply down to increased transfer pricing behaviour of multinational pharmaceutical companies in Ireland to avail of our relatively low rate of corporation tax. The relative stability of Irish exports in the current recession may not be so real after all.

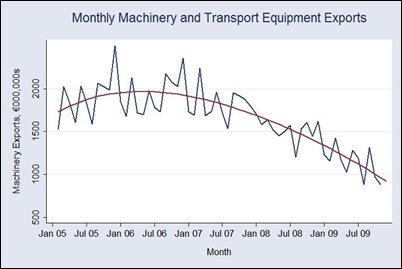

The category ‘machinery and transport equipment’ is symptomatic of what is happening to real Irish exports.

Seven of the ten categories of exports are showing declines, and all seven are showing double-digit declines in line with experiences other countries. It appears our export performance isn’t so strong after all. Tweet

No comments:

Post a Comment